About Course:

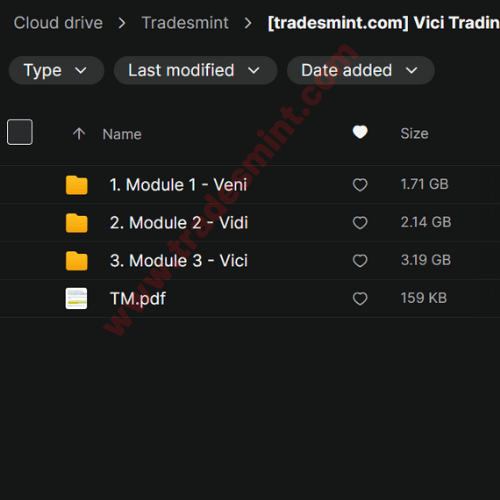

Module 1

- Trading as a Profession: The Emotional Aspect

- The Importance of Chart Reading and Understanding How the Market Moves

- Accumulation and Distribution

- Momentum Moving at the Speed of Price

- Chart Patterns That Work, Candlestick Patterns, and Dojis

- Trend Lines and Why People Use Them

- Market Structure and How to Use It

- Volume Profile and TPO Profile: What They Are

- Trends Within Trends and How to Ride the Move

- Moving Averages: What They Are and How We Use Them

- Fibonacci Levels and Volume Weighted Average Price (VWAP)

- Module 1 “Veni” Complete

Module 2

- Introduction to Module 2 “VEDI”

- Market Profile: What to Look For

- Market Profile: How to Trade It

- Bodies vs Wicks

- Legz: What They Are and How to Define One

- Untested Levels: What They Are and How We Find Them

- Tested Levels, When to Remove Them, and the Re-Manifestation of Levels

- Time Frames: What Matters, Why, and Putting All Time Frames Together

- Time Frames: Knowing Your Reaction and How and When to Use the Proper Time Frame

- Trade the Levels, Take the Profits, and Playing a Significant Level After a Test

- Swing Pivots: What They Are and How We Mark Them

- Progression: Understanding the Ebb and Flow

- Risk Management: Four Topics

Module 3

- Introduction to Module 3 “VICI”

- How to Properly Draw a Stock Chart

- High Lost vs Last Lost and High Lost Support Once Gained

- How to Properly Draw S&P Futures (ES) Charts

- Legs and Legz, Including Leg Hopping

- Understanding What Was Gained and Lost and the Importance of the 4-Hour Time Frame

- Understanding Reset Levels and How to Identify Them

- Shifts in Momentum vs Shifts in Trend

- Wiping Levels for a Pop or Drop and Trading the Failure

- Globex Gained and Lost and the 30-Second Opening Range

- Playing What Was Gained and the Wing Play

- How to Properly Draw Bitcoin

- Congratulations, You Have Completed the Course

Reviews

There are no reviews yet.