About Course:

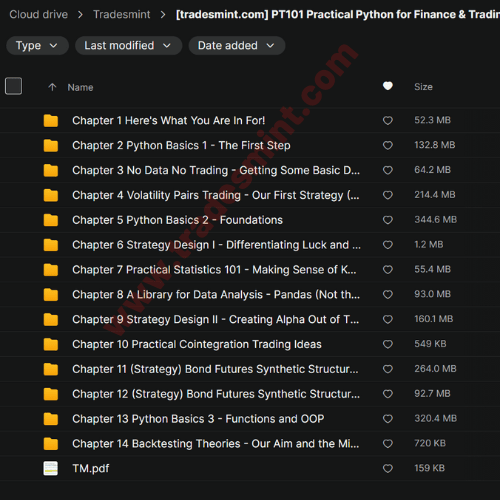

PT101 Practical Python for Finance & Trading Masterclass

Chapter 1 > Here’s What You Are In For!

- Start AT101 or PT101?

- Start Why Code for Trading? The New Mindset – Trading Ideas and Concepts (Part 1)

- Start Why Code for Trading? The New Mindset – Trading Ideas and Concepts (Part 2)

- Start Why Code for Trading? The New Mindset – Trading Ideas and Concepts (Part 3)

- Start The Real Holy Grail of Trading

- Start The First Step – How To Start Your Journey?

- Start Simple vs Complex – Overview and Approach to Strategies in this Course

- Start Teaser Strategy: 1+3-3+1 Bond Futures Calendar Spread

Chapter 2 > Python Basics 1 – The First Step

- Start Why Python over other Programming Languages

- Start AlgoTrading101 Partners with Holistic Coding and Algo-Hunter

- Start Get the Snake – Installing Anaconda

- Start Using the Command Line

- Start Overview of our Research and Execution Tool – Jupyter Notebook

- Start What Snakes are these? Anaconda vs Python

- Start Fastest Way to Open Your Jupyter Notebook

- Start Download Code for Chapter 2

- Start The Basic Building Blocks – Variables and Expressions

- Start Know what You Can Do – Jupyter Notebook & Python Superpower List

- Start Copy Others’ Code – Python Libraries and Packages

Chapter 3 > No Data No Trading – Getting Some Basic Data In

- Start Download Code for Chapter 3

- Start Get Data from Quandl – Let’s Get Apple’s Stock Prices

- Start Quandl WIKI Database Limitations – Yahoo Finance to the Rescue

- Start Installing Library for Yahoo Finance API

- Start Retrieving Data from Yahoo Finance API – Just a One-Liner

Chapter 4 > Volatility Pairs Trading – Our First Strategy (A Teaser into Practical Pair Trading)

- Start 2 Behaviours – Correlation vs Cointegration

- Start Pair Trading – The Basic Cointegration Strategy (Part 1)

- Start Pair Trading – The Basic Cointegration Strategy (Part 2)

- Start Volatility Pairs Trading – Our Teaser Strategy (Intro)

- Start Volatility Pairs Trading – Check it with our Eyes! (Visual Backtesting) – Part 1

- Start Volatility Pairs Trading – Check it with our Eyes! (Visual Backtesting) – Part 2

- Start Longing, Shorting and Spreads

- Start Download Code for Chapter 4

- Start Volatility Pairs Trading – Preparing for the Statistical Backtest

- Start Volatility Pairs Trading – The Real Test! Running our Statistical Backtest (Part 1)

- Start Volatility Pairs Trading – The Real Test! Running our Statistical Backtest (Part 2)

- Start Volatility Pairs Trading – The Real Test! Running our Statistical Backtest (Part 3)

- Start Volatility Pairs Trading – The Real Test! Running our Statistical Backtest (Part 4)

- Start Volatility Pairs Trading – 10 Ideas to Level Up. Adapting to the Real-World

Chapter 5 > Python Basics 2 – Foundations

- Start Just so you don’t feel lost

- Start Running all Cells

- Start Download Code for Chapter 5

- Start Counting stuff in Python

- Start Variables contain different Types of Info – Data Types

- Start The Simplest Table (Lists of Values) + Datetime Management

- Start The Simplest Tables with Unchangeable Values – Tuples

- Start If A happens, do B – Conditional Statements

- Start Printing stuff – Formatting your texts and numbers

- Start Meaning behind String Symbols

- Start Do Something Many Times Using Code – For Loops

- Start Loops Practice 1 – Basic For Loops

- Start Do Something Many Times in a Different Way – While Loops

- Start Loops Practice 2 – Basic While Loops

- Start Looping Twice – Nested Loops

- Start Loops Practice 3 – Nested Loops

- Start If A then B, Many Times – Loops with Conditionals

- Start Loops Practice 4 – Conditional + Nested Loops

- Start Answers to Loops Practice 1 to 4

- Start Loops with some Control (Continue, Break and Pass)

- Start Loops Practice 5 – Calculating Stock Metrics

- Start Answers to Loops Practice 5

- Start For Loops without the Range Method

- Start When to use For vs While Loops

- Start Get Data from CSV and TXT

- Start Exporting dataframe to CSV

- Start Stuck at Programming? Self-Learning and Getting Help Guide

- Start Elegant Code vs Learning Trading

Chapter 6 > Strategy Design I – Differentiating Luck and Skill

- Start The Most Important Concept – Market Prudence

- Start Market Inefficiency Discovery vs Exploitation

- Start David vs Goliath – Can we outwit the Big Funds?

- Start Us vs Hedge Funds: Why We Dislike Trading on Lower Timeframes

- Start Outwitting the Masses – Second-Order Thinking

- Start How to Choose What Markets/Strategies to Trade

- Start Does this course suck? Or is it adding value to you?

Chapter 7 > Practical Statistics 101 – Making Sense of Key Figures

- Start Calculating Long Term Expected Payout of a Robot

- Start Statistical Significance and Law of Large Numbers – More is better

- Start What is an Abnormal Move – Understanding Standard Deviations

- Start Stock Returns Behaviour – Understanding Normal Distributions

- Start Minimum Sample Size and Application to Trading

- Start Cointegration Simplified

- Start Optional Readings on Statistics

- Start What are Correlation and Sensitivity/Regression

- Start The Real Role of Statistics in our Trading

Chapter 8 > A Library for Data Analysis – Pandas (Not the lazy animal!)

- Start Generating Random Numbers

- Start What is Pandas and Why Do We Need It?

- Start Download Code for Chapter 8

- Start Two Column Tables of Data – Dataframe (This one is important)

- Start Managing Dataframes – Editing our Tables

- Start Managing Dataframes 2 – Changing the Shape of our Dataframes

- Start Datetime Management – Adding Dates to Dataframes

- Start Pandas Exercise 1 – All You Need for Managing Dataframes

- Start Changing Dataframe’s Data Type

- Start Not-a-Number? Dealing with NaN and NaT

- Start Pandas Exercise 2 – Managing Non Numbers in your Data

- Start What is a Pandas Series?

Chapter 9 > Strategy Design II – Creating Alpha Out of Thin Air: The Magic of Synthetic Assets

- Start Introduction to Synthetic Assets – Why Does It Produce Alpha

- Start Types of Synthetic Assets – Hedging in Different Ways (Part 1)

- Start Types of Synthetic Assets – Hedging in Different Ways (Part 2)

- Start Moving Beyond Spreads – Spread^2 and Others

- Start Download Code for the Chapter

- Start Practice 1 (Questions) – Dollar-Hedged Structure

- Start Practice 1 (Answers) – Dollar-Hedged Structure (Part 1)

- Start Practice 1 (Answers) – Dollar-Hedged Structure (Part 2)

- Start Manipulating the Shapes of Structures using Multipliers

- Start Effect of Multipliers – Summary

- Start An Impossible Structure – One Ranging and One Trending

- Start Normalising the first value to 1

- Start Market-Hedging and Other Hedges

Chapter 10 > Practical Cointegration Trading Ideas

- Start 3 Cointegration Trading Ideas that we can Implement

- Start No-Code Trading Research Tools – Do Quick Research before Committing

Chapter 11 (Strategy) > Bond Futures Synthetic Structures – The Calendar Spreads I

- Start Bond Futures Calendar Spreads (Part 1) – One of the Most Stable Synthetic Asset – Introduction

- Start Bond Yields and Prices – They are Inverse!

- Start Bond Futures Calendar Spreads (Part 2) – Understanding the Fundamental Idea

- Start Finding Alpha in STIR Futures

- Start Download code for this chapter

- Start Code to download BAX data + 2 Coding tasks for you

- Start Downloading and Cleaning BAX Data

- Start Calculating and Plotting a Double Butterfly in Python (Part 1)

- Start Calculating and Plotting a Double Butterfly in Python (Part 2)

- Start The Easy Way – Charting STIR Futures Structures on Tradingview

- Start List of STIR Futures – Common and Less Common STIRs

- Start Opening a Interactive Brokers Demo account to Trade STIR Futures

- Start Using Interactive Brokers’ Booktrader (aka price ladder)

- Start Bond Futures Calendar Spreads (Part 3) – The Essence of the Strategy: Execution

- Start Bond Futures Calendar Spreads (Part 4) – The Source of Alpha: Level Up Your Execution

- Start Prepare for Battle – Set up your Interactive Brokers Layout (Part 1)

- Start Prepare for Battle – Set up your Interactive Brokers Layout (Part 2)

- Start Finding Your Asset in Interactive Brokers

- Start Mental Sums – Calculating Price of Double Butterfly from Booktraders

- Start Time for Battle! Demonstrating How to Execute a D.Butterfly (Part 1)

- Start Time for Battle! Demonstrating How to Execute a D.Butterfly (Part 2)

Chapter 12 (Strategy) > Bond Futures Synthetic Structures – The Calendar Spreads II

- Start New Weapon – Combination Order

- Start Demonstrating the new weapon – The Combination Order

- Start Understanding the Combination Order

- Start Bond Futures Calendar Spreads (Part 5) – Multi-Quarter Structures and Structures Equivalence

- Start A New Weapon – Finding Opportunities in the Term Structure (Part 1)

- Start A New Weapon – Finding Opportunities in the Term Structure (Part 2)

- Start Term Structure and STIR Pricing

- Start Bond Futures Calendar Spreads (Part 6) – Trading with the Drift

- Start Bond Futures Calendar Spreads (Part 7) – Strategy Difficulties and Risks

- Start Downloading and Storing BAX data in Bulk

- Start How much $ do you need for this strategy – Capital Requirements

- Start Bond Futures Calendar Spreads (Part 8) – Backtesting and other Considerations

- Start STIR Trade Sizing and Non-Entry/Exit System

- Start BAX End Note

Chapter 13 > Python Basics 3 – Functions and OOP

- Start Those who are good at Python can skip this chapter

- Start What are Functions – Our Little Factories

- Start Download Code

- Start User-Defined Functions – Learn to Code Your Own Factories!

- Start Functions Practice 1 – Questions

- Start Functions Practice 1 – Solutions (Part 1)

- Start Functions Practice 1 – Solutions (Part 2)

- Start What are Scripts – Simple Python file (Also: How to import your own code)

- Start Uses of Python Scripts vs Jupyter Notebooks

- Start Modules vs Libraries vs Packages – Understanding the Terminologies

- Start OOP Series – Object-Oriented Programming (OOP) Simplified. Objects store values and/or does stuff

- Start OOP Series – Difference between Classes and Objects

- Start OOP Series – Why do we need to learn OOP? Ans: We have no choice

- Start OOP Series – Object Variables: Storing Values (Part 1)

- Start OOP Series – Object Variables: Storing Values (Part 2)

- Start OOP Series – Object Functions: Doing stuff

- Start Objects Practice 1 – Object Variables (Questions + Solutions)

- Start Objects Practice 2 – Object Functions (Questions)

- Start Objects Practice 2 – Object Functions (Solutions) Part 1

- Start Objects Practice 2 – Object Functions (Solutions) Part 2

- Start Naming Conventions – How to name your classes, variables etc

Chapter 14 > Backtesting Theories – Our Aim and the Mistakes to Avoid

- Start What is Backtesting – Simplified

- Start The Aim of Backtesting – We are NOT trying to build the Ultimate Strategy

- Start 3 Big Mistakes of Backtesting – 1) Overfitting 2) Look-Ahead Bias 3) P-Hacking

- Start Solution to the 3 Big Mistakes in Backtesting

Reviews

There are no reviews yet.