About Course:

AT101 Algorithmic Trading Immersive Course

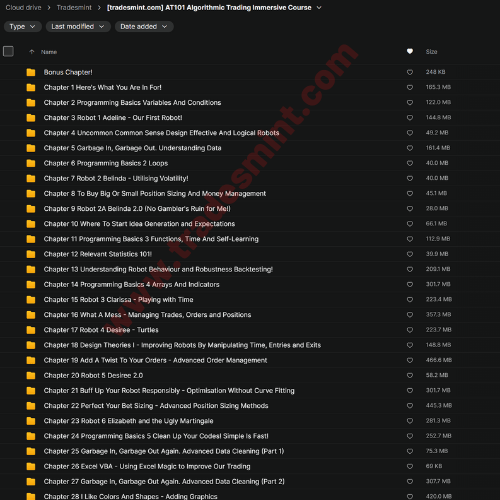

Chapter 1 > Here’s What You Are in for!

- AT101 is Revamped!

- What are Trading Robots? (And why should I build them?) (Part 1)

- What are Trading Robots? (And why should I build them?) (Part 2)

- The First Step – How to Start Your Journey?

- MT4 Installer Direct Download

- MT4 for Mac

- Downloading Our Software (MT4)

- Introduction to MT4

- MT4 Basic Guide

- Download Template

- Structure of a Trading Robot (Part 1)

- Structure of a Trading Robot (Part 2)

- Structure of a Trading Robot (Part 3)

- Why choose MT4 over other software?

- Our Holy Grail – Secret to Successful Trading Robots

Chapter 2 > Programming Basics: Variables and Conditions

- The 3 Types of Code

- Syntax – The ABCs of Coding (Part 1)

- Syntax – The ABCs of Coding (Part 2)

- Reserved Words – Words you cannot use!

- Variables – The basic building blocks!

- Download Code for Expressions

- Expressions and Operations (Plus, Minus, Multiplication and Division)

- Operations and Precedence – Who comes first

- Conditional – If this then that (Part 1)

- Conditional – If this then that (Part 2)

- Chapter 2 Summary

Chapter 3 > Robot 1: Adeline – Our First Robot!

- Background to our Asset Class

- Chart Reading 101

- Download Codes for Adeline

- Theory behind Robot Adeline

- Coding Adeline (Part 1)

- Coding Adeline (Part 2)

- Understanding Shift

- Dry Run! – Our Robot Testing System (Part 1)

- Dry Run! – Our Robot Testing System (Part 2)

- 3 Types of Testing Method (Simple)

- Chapter 3 Summary

- Don’t worry about not understanding the code!

Chapter 4 > Uncommon Common Sense: Design Effective and Logical Robots

- Trading Robot Development Guide – Everything You Need to Succeed (Part 1)

- Trading Robot Development Guide – Everything You Need to Succeed (Part 2)

- Trading Robot Development Guide – Everything You Need to Succeed (Part 3)

- Pros and Cons of Trading Robots – Nothing is Perfect

- Calculating Long Term Expected Payout of a Robot

- Useful Resources

- Chapter 4 Summary

- Let’s Make the Course More Awesome

- Start Coding Your Own Trading Strategies

- Moving to Python?

Chapter 5 > Garbage In, Garbage Out. Understanding Data

- Data Sources and Storage

- Data Management

- Download Dirty Data

- Cleaning Data (Part 1)

- Cleaning Data (Part 2)

- Cleaning Data (Part 3)

- Trading on Bad Ticks – Avoid the Scammers in the Markets

- We are giving away 10GB of data! + Other Data Sources

Chapter 6 > Programming Basics 2: Loops

- Loops – Running a piece of code many times (Part 1)

- Download Code for Loops

- Loops – Running a piece of code many times (Part 2)

Chapter 7 > Robot 2: Belinda – Utilising Volatility!

- Quantifying Volatility – How Big are Average Price Movements?!

- Introducing our 2nd Robot: Belinda

- Download Belinda

- Coding and Testing Belinda

Chapter 8 > To Buy Big or Small? Position Sizing and Money Management

- Enable Macros for Excel

- Coin Flip Game – Understand Bet Sizing by Flipping Coins

- Theory behind Bet Sizing (aka Position Sizing/Money Management)

- Download Codes for this Chapter and the Next

Chapter 9 > Robot 2A: Belinda 2.0 (No Gambler’s Ruin for Me!)

- Coding our Sizing Algorithm!

- Upgrade time! – Adding Sizing Algos to Belinda

- Sizing Algo for Deposit Currency

- Brief Note – Market Opportunities in Forex vs CFDs!

- A Note on Simple Price Action – Adeline and Belinda

Chapter 10 > Where to Start? Idea Generation and Expectations

- Expectation of Strategies and Equity Curves (Part 1)

- Expectation of Strategies and Equity Curves (Part 2)

- Preliminary Research – First step to building Robots (Part 1)

- Preliminary Research – First step to building Robots (Part 2)

- Sources of Ideas!

- Strategy Creation Thought Process (Part 1) – A Closer look at Market Prudence

- What are Leading and Lagging Indicators

- Strategy Creation Thought Process (Part 2) – Think of Relationships

- Understanding Entries and Exits

- David vs Goliath – Can we outwit the big Funds?

- Don’t trade solely with Indicators

- Does this course suck? Or is it adding value to you?

Chapter 11 > Programming Basics 3: Functions, Time and Self-Learning

- Still lost at programming? Self-Learning Methods

- Types of Errors! And Common Coding Problems!

- Download Code

- Debugging Demonstration – Understanding the Thought Process

- Functions – Little Factories

- Coding User-Defined Functions

- When 2 lines cross – Creating a Cross Function

- Functions with No Output – Returning Void

- What is #Define

- Understanding Time and Dates

- Coding Practice!

Chapter 12 > Relevant Statistics 101!

- Statistical Significance and Law of Large Numbers – More is better

- Minimum Sample Size and Application to Trading

- Optional Readings on Statistics

- Minimum Sample Size vs Live Performance (Good Backtest! = Good Live Results)

Chapter 13 > Understanding Robot Behaviour and Robustness: Backtesting!

- The Aim of Backtesting – We are NOT trying to build the Ultimate Strategy

- Volatility and Timeframes

- 4 Main Types of Market Conditions

- Downloading Codes for Chapter 13

- Checking Trades – Ensuring Accuracy in the Codes

- Swap Rates – Overnight Costs

- Carry Trade – Earning from Interest Differentials

- 3 Types of Testing Method (Detailed)

- Modelling Quality – A Meaningless Number?

- Every Tick Testing Issue – Once Upon a Bar (Part 1)

- Every Tick Testing Issue – Once Upon a Bar (Part 2)

- Robustness – Staying Effective through Change

- Reminder: Don’t try to build the ultimate robust robot

- Fractals – Timeframe Robustness (NOT referring to candlestick patterns)

- Period and Timeframe Robustness

- Period Robustness (Part 2) – Market Prudence

- Seasonal Robustness – Repetitive Behavior in the Markets

- Seasonal Effects: Best Times to Trade

- Instrument Robustness Analysis

- Black Swans – Stress Testing our Robots through Tough Times

- Strategic Market Conditions (Part 1) – Building Robots for Specific Market Types

- Strategic Market Conditions (Part 2) – Recap, Market Prudence and Identifying SMC

- Parameter Value Selection: A Glimpse into Curve Fitting Bias

- Butterfly Effect: Start Point Phenomenon

- Robustness – A Summary

- Pass or fail? Backtest Performance Analysis

- Quick Technical Guide: Running your trading robot live

Chapter 14 > Programming Basics 4: Arrays and Indicators

- Mentality towards Technical Indicators – Not Magic Numbers

- Math behind Technical Indicators (Part 1)

- Math behind Technical Indicators (Part 2)

- Arrays – Invisible Tables of Data

- Download Codes for Arrays

- Programming Arrays (Part 1)

- Programming Arrays (Part 2)

- Programming Practice! – Arrays

- Buffers – Special Arrays for Indicators

- Structure of Indicators (Part 1)

- Structure of Indicators (Part 2)

- Explaining Indicator Code (Part 1)

- Explaining Indicator Code (Part 2)

- New Indicator Code and Property Strict

- Indicator Coding Practice 1: Replicating an Indicator Manually

- Indicator Information

- Indicator Coding Practice 2: Multiple Buffers

- Calling Self-Made Indicators – Using iCustom

- Indicator Code Resources

Chapter 15 > Robot 3: Clarissa – Playing with Time

- Download Code for Datetime Script and Clarissa

- Understanding the Datetime Data Type

- Coding for Seasonal Effects – Managing Date and Time (Part 1)

- Coding for Seasonal Effects – Managing Date and Time (Part 2)

- Introducing our 3rd Robot: Clarissa

- Coding and Testing Clarissa (Part 1)

- Coding and Testing Clarissa (Part 2)

- Coding and Testing Clarissa (Part 3)

Chapter 16 > What A Mess – Managing Trades, Orders and Positions

- Mixing it up: Multiple Order Types

- Understanding Market Makers – Can We Trade Like Them?

- Download Codes for Clarissa Modified and Falcon Template

- Managing 4- and 5-Digit Brokers

- Adjusting for Yen Pairs

- Order Limitations: Stop and Freeze Levels

- Upgrade Time: Introducing Falcon Template 1.0

- Order Functions

- Managing Orders with Code

- Market vs Instant Execution

- Upgrade Time: OrderSend Function Falcon 1.0

- Understanding Spread

- 4 More Order Types – Send Pending Orders

- Managing Multiple Positions with One Robot

- Closing Positions and Orders

- Breaking it up – Closing Orders Partially

- Risk Management – Limiting Trades when Things Go South

- Understanding Slippages and Requotes

- Handling Errors in Falcon

Chapter 17 > Robot 4: Desiree – Turtles

- History of the Turtle Traders Experiment – Converting Beginners to Top Traders

- Introducing our 4th Robot: Desiree

- Download Code for Donchian and Desiree

- Coding Our Turtle Indicator – Donchian Channels

- Coding and Testing Desiree (Part 1)

- Coding and Testing Desiree (Part 2)

- Coding and Testing Desiree (Part 3)

- Coding and Testing Desiree (Part 4)

- Let’s Make the Course More Awesome (Again!)

Chapter 18 > Design Theories I – Improving Robots by Manipulating Time, Entries and Exits

- Modelling Transaction Costs: Commissions, Spreads and Slippages

- Why We Dislike Lower Timeframes

- Same Robot. Different Timeframes. Different Performances.

- Understanding Stop Loss – Prudence and Noise Buffer

- Adaptive Components in Strategies

- Which should I use – Stops vs Trailing Stops

- Which is more Important – Entries vs Exits (Trade Management)

- Asymmetrical Rules – Long Short Bias

Chapter 19 > Add A Twist to Your Orders – Advanced Order Management

- Executing Trades Immediately – “Every tick” Backtesting

- Don’t Get Targeted – Hidden Stop and Take Profit (Part 1)

- Don’t Get Targeted – Hidden Stop and Take Profit (Part 2)

- Pseudo Logic: Breakeven Stops

- Optional Content

- Download code for Chapter

- Coding Hidden Stop and Take Profit (Part 1)

- Coding Hidden Stop and Take Profit (Part 2)

- Coding Hidden Stop and Take Profit (Part 3)

- Hidden Functions and “Every tick”

- 5 Types of Trailing Stops

- Coding Trailing Stops

- Coding Hidden Trailing Stops (Part 1)

- Coding Hidden Trailing Stops (Part 2)

- Coding Volatility Trailing Stops (Part 1)

- Coding Volatility Trailing Stops (Part 2)

- Coding Hidden Volatility Trailing Stops

- Manage Uncertainty – Limiting Trades When Volatility Spikes

- Adaptive Volatility Trailing Stops

Chapter 20 > Robot 5: Desiree 2.0

- Download Code for Desiree 2.0

- Coding Desiree 2.0

Chapter 21 > Buff Up Your Robot Responsibly – Optimisation Without Curve Fitting

- Introduction to Optimisation

- What To Aim For – Understanding Objective Functions

- Optimisation in MT4 (Part 1)

- Optimisation in MT4 (Part 2)

- Genetic Algorithm in English

- Optimisation in MT4 – A Look behind the Scenes

- Past Doesn’t Predict Future – Understanding Curve Fitting

- Optimising for the Future – 10 Ways to Minimise Curve Fitting

- Limitations in MT4’s Optimisation

- Types of Limitations

- Too Much Freedom is Bad – Understanding Degrees of Freedom

- Fuzzy Definition of Degrees of Freedom

- Setting up your Optimisation – Understanding Parameters

- In and Out-of-Sample Data – Training and Testing

- Optimisation Evaluation – Parameter Space Analysis (Part 1)

- Optimisation Evaluation – Parameter Space Analysis (Part 2)

- Independent Variables Optimisation – Breaking the Process Apart (Part 1)

- Independent Variables Optimisation – Breaking the Process Apart (Part 2)

- Quiz on Optimisation – Maximising Performance the Right Way

- Speeding Up Your Optimisations! Don’t Run Irrelevant Tests

- 3 Big Mistakes of Backtesting/Optimisation – 1) Overfitting 2) Look-Ahead Bias 3) P-Hacking

- Solution to the 3 Big Mistakes in Backtesting/Optimisation

Chapter 22 > Perfect Your Bet Sizing – Advanced Position Sizing Methods

- Enable Macros for Excel

- Beyond Risk = 2% – Optimising Risk Per Trade

- Download Code for Advanced Position Sizing

- Our Sizing Trilemma – The Impossible Trinity of Sizing

- Check Your Sizing – Ensuring Lot Size Compatibility

- Be Nimble Not Clunky – Breaking Down Large Orders

- Reference Hidden/Trailing Stops – Modifying Our Sizing Algo

- A Proposed “Optimal” Bet Sizing Algo – The Kelly (Part 1)

- A Proposed “Optimal” Bet Sizing Algo – The Kelly (Part 2)

- Kelly Criterion Resources

- Coding the Adaptive Kelly Sizing Algorithm (Part 1)

- Coding the Adaptive Kelly Sizing Algorithm (Part 2)

- Coding Hit Rate and Reward Ratio Functions

- Notes on Adaptive Sizing

- Adaptive Position Sizing – Tailoring to Target Factors (Part 1)

- Adaptive Position Sizing – Tailoring to Target Factors (Part 2)

- Coding an Adaptive Volatility Sizing Model

- Formulating Adaptive Sizing Algorithms

- Coding an Adaptive Hit Rate Sizing Model

- Summary – Reviewing our 3 Sizing Methods

- Is this course of good value?

Chapter 23 > Robot 6: Elizabeth and the Ugly Martingale

- Elizabeth – Martingale and Myths (Part 1)

- Elizabeth – Martingale and Myths (Part 2)

- Elizabeth’s Rules

- Download Elizabeth

- Coding Elizabeth (Part 1)

- Coding Elizabeth (Part 2)

- Elizabeth Upgraded – Introducing Elizabella

- Programming Elizabella (Part 1)

- Programming Elizabella (Part 2)

- Programming Elizabella (Part 3)

Chapter 24 > Programming Basics 5: Clean Up Your Codes! Simple Is Fast!

- MT4’s Global Variables (Not referring to global scope!)

- Download Code for Programming Basics 5

- Coding Simple Global Variables

- Coding Global Variables (Spread)

- Coding Global Variables In an Indicator (Highest Spread)

- Cleaner Code 1 – Record Backtest Timings

- Cleaner Code 2 – Coding Principles!

- Cleaner Code 3 – Once a Bar

- Cleaner Code 4 – Partial Once a Bar + Once an Entry/Exit

- Cleaner Code 5 – Efficient Indicators

- Include vs Import

- Coding with the Include method

- Coding with the Import method

- Dynamic Link Library (DLL)

- Code Robustness – Write Good Code

Chapter 25 > Garbage In, Garbage Out Again. Advanced Data Cleaning (Part 1)

- Offline Testing and Multiple MT4 Instances

- Backtesting – Designated vs Actual Period

- Download Code for Advanced Data Management (Part 1)

- Creating Custom Timeframes

- Backtesting with Custom Timeframes

- Different Data, Different Output – Reconciling Backtest Results

- Clean Data, Biased Output – Backtesting vs Live Trading Results

- 1 Min Intrabar – Behind the Scenes

Chapter 26 > Excel VBA – Using Excel Magic to Improve Our Trading

- Check out the VBA Course

Chapter 27 > Garbage In, Garbage Out Again. Advanced Data Cleaning (Part 2)

- Managing Time Zone Difference between Data and Broker

- Understanding Date and Time in Excel

- Download Code and Files for this Chapter

- Modifying Dates and Time of our Data (Part 1)

- Modifying Dates and Time of our Data (Part 2)

- Data Cleaning Series – Definition of Clean Data

- Data Cleaning Series – Problems with Dirty Data (Generic)

- G in G Out Framework (Theory) – The Mega Data Cleaning Framework (Part 1)

- G in G Out Framework (Theory) – The Mega Data Cleaning Framework (Part 2)

- G in G out Framework (Practical) – Listing and Scanning for Errors

- G in G out Framework (Practical) – Basic Error Visualisation

- Excel How-To: Scatter Plot and Histogram

- G in G out Framework (Practical) – Fixing Errors using Clean Reference Data

- Limitations of Excel – Dealing with Large Dataset

- A Glimpse into Advanced Data Chapter (Part 3)

Chapter 28 > I Like Colors and Shapes – Adding Graphics

- Download Code for Chapter

- Building Dashboards with Comments

- Building Dashboards with Comments (Falcon 2.5)

- Building Dashboards – Indicators vs Scripts

- Creating and Deleting Graphical Objects – Shapes, Arrows, Lines, Words (Part 1)

- Creating and Deleting Graphical Objects – Shapes, Arrows, Lines, Words (Part 2)

- Creating and Deleting Graphical Objects – Immovable Words

- Modifying Objects (Properties) – Thicker lines, changing colours etc (Part 1)

- Modifying Objects (Properties) – Thicker lines, changing colours etc (Part 2)

- Displaying Your Information – Dashboard (Indicator)

- Creating Buttons and Dealing with Chart Events (Part 1)

- Creating Buttons and Dealing with Chart Events (Part 2)

Chapter 29 > Ring Ring! Notify Yourself When Something Goes Wrong (Or right)

- Introduction to MT4 Notifications

- Download Code for Notifications Chapter

- Coding Notifications – 6 Case Studies

- Trade Notifications with no coding!

- MetaTrader 4 General Alerts

Chapter 30 > Robot 7: Faye – Semi-Automated Trading

- Download Code for Faye

- Programming Faye 01 – Trade + Alerts

- Faye 02 Theory – Semi-Automated Robot

- Programming Faye 02 – Semi-Automated Robot (Alert Only)

Chapter 31 > Connect with the outside world – Importing and Exporting Data out of our Trading Platform

- Expanding our Trading Options – Reasons for Reading and Writing Data

- Download Code

- One number – Read and Write data (Part 1)

- Multiple numbers – Read and Write data (Part 2)

- Write to the end + Error Management – Read and Write data (Part 3)

- Storing Files – Non-tester vs Tester

- Recording Spreads: Bid-Ask Spread Logger

Chapter 32 > Programming Basics 6: Trading Platform Nuances

- Download Code for Programming Basics 6

- The Little Details – MT4 Nuances (Part 1)

- The Little Details – MT4 Nuances (Part 2)

- Modifying Function Inputs – Multiple Outputs and Arrays

- Backtest Accuracy – Different Quote and Deposit Currencies

- Fixing with Custom Tick Values (Programming) – Different Quote and Deposit Currencies

- Testing Features and Limitations in MT4

Chapter 33 > Design Theories II – The “Secret Sauce”

- Mindset behind Strategies: Prudence-Behavioural Framework (Fundamentals vs Statistics)

- Types of Alpha (Introduction)

- Alpha Type 1: Data (Numbers, Images and Text)

- Alpha Type 2: Global Macro

- Alpha Type 3: High-Frequency Trading

- Alpha Type 4: Market Microstructure

- The Hybrid Model – Semi-Algorithmic Trading (Algo + Manual)

- Practical Understanding of Commissions, Volatility and Shift

- 5 Realities of Algorithmic Trading – All Strategies Die Eventually

- Crowd Behaviour – Outwitting the Masses

Chapter 34 > Walk Forward Optimisation – The Most Important Step in Testing

- What is Walk Forward Optimisation and Why I Do Need it?

- Wthout WFO – Wrong Way to Optimise. Making 2700%

- WFO Demonstration

- Download Code and File

- Recording Results, Expectations and Automation

- WFO Does Not Eliminate Curve Fitting – Look-Ahead and P-Hacking

- Profit is Not Enough – Customising Objective Functions

- Coding Customised Objective Functions (Part 1)

- Coding Customised Objective Functions (Part 2)

- Size of In and Out-of-Samples + Overall Duration

- Walk Forward Robustness and Performance Analysis

Chapter 35 > Trading Non-Forex CFDs with MT4 (Stocks, Commodities, Fixed Income and Crypto)

- MT4 EAs for CFDs – Understanding the difference with Forex EA

- Download code for this chapter

- Demo accounts for CFDs

Chapter 36 > Trading on External and Alternative Data with MT4

- External Information Inputs – Adding Alpha to Our Strategies

- Download Code for Chapter

Bonus Chapter!

- Falcon Template – Our Main Robot Template

Reviews

There are no reviews yet.